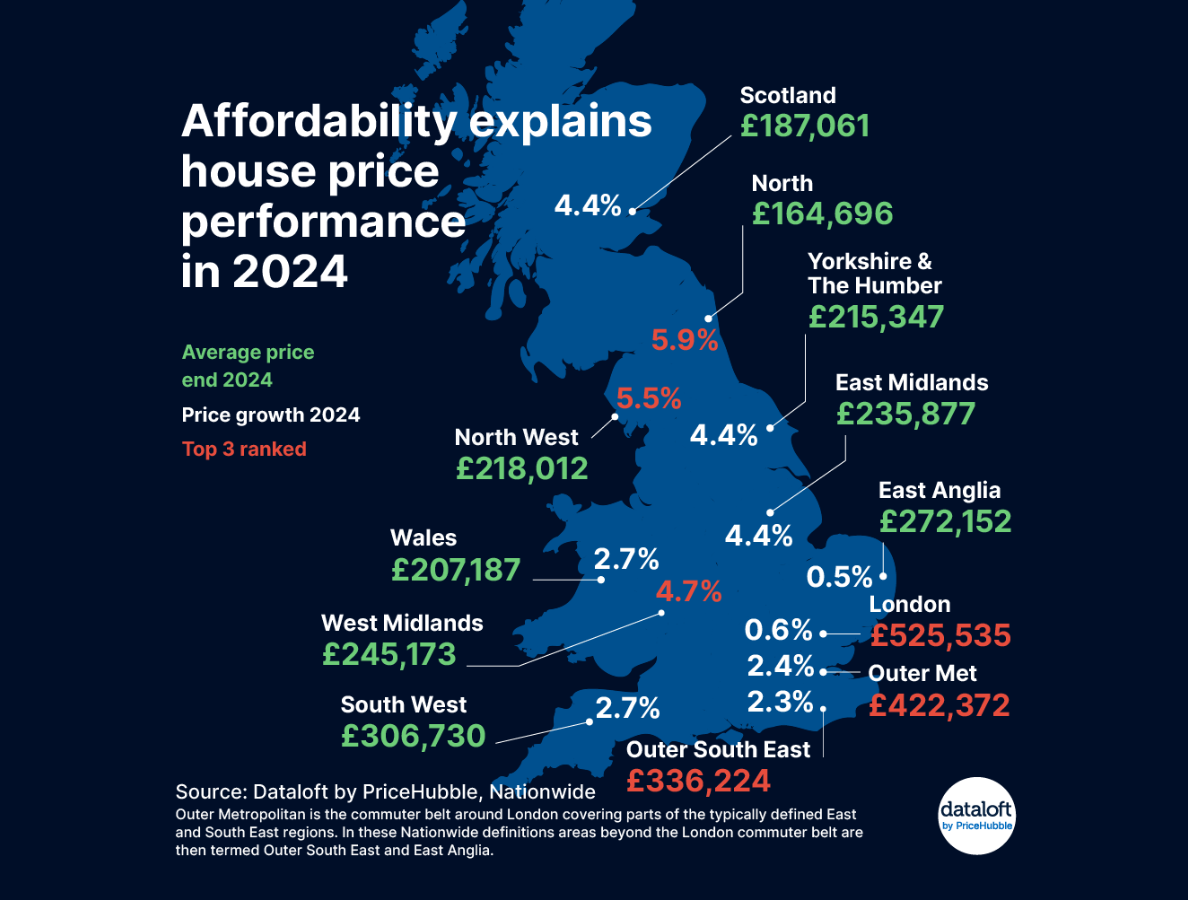

The performance of the UK housing market in 2024 has highlighted significant regional disparities. While the national average house price increased by 3.6%, regional variations were stark, with the North leading the way at a 5.9% increase and East Anglia experiencing a modest growth of just 0.5%. These variations underline the central role affordability plays in determining house price performance.

Regional Performance: A Tale of Affordability

The affordability of housing has emerged as a key factor differentiating regional performance. Regions that experienced lower price growth, such as London, the South East, and the Outer Metropolitan area, are also among the most expensive in the UK. In contrast, the North, which remains relatively affordable, saw the strongest growth, benefiting from increased demand as buyers sought more cost-effective options.

The Impact of Mortgage Rates

A major factor influencing affordability in 2024 has been the shift to higher mortgage rates. Expensive regions like London and the South East have felt the brunt of this change, as higher borrowing costs exacerbate already challenging affordability levels. For many potential buyers, the combination of high property prices and increased mortgage rates has created significant barriers to entry, dampening price growth in these areas.

The Bank of England’s monetary policy decisions have played a pivotal role in shaping market conditions. Further interest rate cuts anticipated in 2025 are expected to ease the pressure on mortgage rates, potentially improving affordability, particularly in regions with high property values. This could provide some much-needed relief to markets such as London and the commuter belt, which have struggled under the weight of high borrowing costs.

Affordability: The Critical Driver for 2025

As we look ahead to 2025, affordability is set to remain the central theme influencing house price dynamics. While house prices are expected to rise, the macroeconomic environment offers limited support for significant growth. Wage growth, inflation, and borrowing costs will continue to shape buyer behavior and affordability levels. Regions with lower price points and better affordability metrics are likely to maintain their momentum. Areas such as the North and the Midlands, which offer relatively lower entry costs, are expected to attract sustained demand from both first-time buyers and investors. Conversely, expensive regions will likely experience slower growth unless there is a significant improvement in affordability metrics driven by lower mortgage rates or higher wage growth.

The Long-Term Outlook

The affordability challenge underscores the importance of balancing supply and demand across the housing market. Government initiatives to address housing shortages and improve affordability could play a crucial role in shaping future price trends. Additionally, technological advancements in remote working and evolving lifestyle preferences may continue to influence regional dynamics, further emphasizing the need for a diversified housing strategy.

Image by wayhomestudio on Freepik

Source: Dataloft by PriceHubble, Nationwide

Share this article

More Articles

Sign up for our newsletter

Subscribe to receive the latest property market information to your inbox, full of market knowledge and tips for your home.

You may unsubscribe at any time. See our Privacy Policy.